Modern Service Industry

National Backbone Cold Chain Logistics Base Project of Siping City

1. Introduction to the Project

1.1 Project background

1.1.1 Product introduction

Cold chain logistics is a special logistics transportation method aimed at maintaining the freshness and quality of food or other products, and reducing losses during transportation. Throughout the entire supply chain, including processing, storage, transportation, distribution, and retail, goods are always maintained at a certain temperature condition. Cold chain logistics involves multiple aspects such as pre cooling treatment, cold chain processing, cold chain storage, cold chain transportation and distribution, as well as cold chain sales, and utilizes facilities such as cold storage, refrigerated trucks, insulated boxes, and refrigerated display cabinets.

The project mainly constructs a cold chain logistics base. Taking the integration of existing cold chain logistics resources as the main line, focusing on the advantageous production areas and distribution centers of high value-added fresh agricultural products (including characteristic agricultural products of Northeast China, fruits and vegetables, livestock and poultry, dairy products, aquatic products, flowers, etc.), relying on the existing cold chain logistics infrastructure group to build a number of national backbone cold chain logistics bases, integrating and gathering the supply and demand of the cold chain logistics market, existing facilities, as well as upstream and downstream industrial resources such as agricultural product circulation and production processing, improving the scale, intensification, organization, and networking level of cold chain logistics, supporting the industrialization development of fresh agricultural products, and promoting the upgrading of consumption of urban and rural residents.

1.1.2 Market prospect

(1) Analysis of the global cold chain logistics market

The demand for agricultural products in most countries around the world is met through cold chain logistics, but its operation is constrained by various factors. Taking swine flu for example, it has recently had an impact on the German pork supply chain, leading to the restructuring of the European pork supply chain and the adoption of border control measures by many countries. Taking the UK for example, in April 2020, the cold chain storage resources for agricultural products in the UK have become increasingly scarce. Lineage, a leading global cold chain company, has revealed that 90% of their capacity in 15 cold storage facilities in the UK is already in use. A large amount of food is piled up in cold storage, leading to a significant decrease in demand for cold chain logistics of agricultural products in the UK. It is expected that the actual transportation volume will only be 40% to 60% of normal demand, and some drivers are also on vacation.

According to the 2023-2032 OECD FAO Agricultural Outlook released by the International Organization for Economic Cooperation and Development and the Food and Agriculture Organization, the growth of agricultural output in major regions of the world will range from 5% to 25% from 2023 to 2030. The sustained increase in agricultural production will drive the sustained rise in demand for cold chain logistics. Statistics show that changes in household consumption habits have led to a continuous increase in demand for cold chain agricultural products. In France, the demand for cold chain agricultural products increased by 60% in 2020 compared to the past. Overall, with the continuous growth of agricultural production and the expansion of demand markets in the future, the global agricultural cold chain market is expected to continue to expand in size.

Despite the enormous challenges facing the global economic environment, internationally leading cold chain logistics companies continue to maintain stable development, with their internationalization, technological advancement, and high-quality quantitative strategies becoming increasingly prominent. Amercold’s cold chain network is widely distributed in over 20 countries in North America, Europe, and the Asia Pacific region; European cold chain giant DFDS has dozens of refrigeration facilities and thousands of its own refrigerating fleet in Europe.

From the layout of cold chain equipment, cold chain logistics giants in developed countries mainly focus on warehousing, with transportation services often outsourced, especially in the United States. According to the Global Cold Storage and logistics Supplier Rankings 2023 released by the International Association of Refrigerated Warehouses (IARW), the top three companies in terms of global cold storage capacity are Lineage logistics, Americold logistics, and United States Cold Storage, Inc. Their cold storage capacity is 2.848 billion cubic feet, 1.477 billion cubic feet, and 423 million cubic feet, respectively.

(2) Analysis of the prospects for the development of cold chain logistics in China

Cold chain logistics runs through the primary, secondary, and tertiary industries, playing a key role in consolidating poverty alleviation achievements, smoothly promoting rural revitalization, and driving consumption level improvement. It is a market full of potential in the logistics field. In the 14th Five-Year Plan, China explicitly proposed to “build a modern logistics system, accelerate the development of cold chain logistics, integrate logistics hubs, main routes, regional distribution centers, and end distribution nodes, optimize the facilities and conditions of national logistics hubs and backbone cold chain logistics bases”. This indicates that the development of cold chain logistics will become a key driving force in building a new development pattern of dual circulation.

With the rise of cold chain logistics as an emerging industry, its development momentum has been strong in recent years. With the increasing demand in the cold chain market, governments around the world are constantly introducing policies to promote the development of this industry. From a global perspective, it is expected that the global cold chain logistics market will grow from $160 billion in 2018 to $585.1 billion in 2026, with an average annual compound growth rate of nearly 10%. According to reports from foreign research institutions, compared to some regions such as North America and Western Europe, the Asia Pacific region will become the main driving force for global market growth in the next 5 to 10 years, with China being a key contributor to the region’s growth. Thanks to the rapidly growing demand for cold chain and the development of related infrastructure, China has grown into an important emerging market and is rapidly transforming from a production led economy to a consumption led economy.

In China, with the continuous growth of urban and rural residents’ income, consumers’ demands for food diversity, nutrition, and taste are also constantly increasing. At the same time, the rapid development of the fresh e-commerce market has also jointly promoted the rapid development of the cold chain logistics industry. According to publicly available data, the scale of the domestic cold chain logistics market continued to expand from 2015 to 2019, with an average annual compound growth rate of about 17%. In 2019, the market size of the cold chain logistics industry reached 339.1 billion yuan, a year-on-year increase of 17.50%. In 2020, the overall market size achieved the largest growth in recent years, with an output value exceeding 400 billion yuan. By 2021, the market size has exceeded 450 billion yuan. Considering the strong growth momentum in the future, according to this growth rate forecast, the scale of China’s cold chain logistics market will have further increased to about 897 billion yuan by 2025.

At present, the loss rate of most fresh food supplies in China is still high, and the decay rate of fresh products is significantly higher than the average level in developed countries. For example, the decay rate of fruits and vegetables in China is about three times that of developed countries; the decay rate of aquatic products is about twice that of developed countries. Compared with developed countries, the cold chain transportation rates of fruits, vegetables, meat, and aquatic products in China are 35%, 57%, and 69%, respectively, while the average cold chain transportation rates in developed countries are as high as 90%, 80%, and 95%, respectively.

In summary, the current development of China’s cold chain logistics industry continues to improve in terms of economy, policies, and social environment. Upstream infrastructure continues to improve, and downstream demand remains strong. This indicates that the development opportunity for China’s cold chain logistics has arrived, and the industry’s development prospects are very optimistic. It may usher in a golden period of development in the future.

1.1.3 Advantageous conditions of project construction

(1) Policy conditions

In August, 2021, the Special Action Plan for High-quality Development of Commercial logistics (2021-2025) proposed to strengthen the planning of cold chain logistics, lay out and construct a number of national backbone cold chain logistics bases, support the construction and renovation of large-scale agricultural product wholesale markets, import and export ports, and promote the application of new cold chain facilities and equipment such as mobile cold storage, constant temperature refrigerating trucks, and refrigerating containers. Improve the equipment of end of pipe cold chain facilities and enhance the network coverage level of urban and rural cold chain facilities. Encourage eligible enterprises to develop intelligent monitoring and traceability platforms for cold chain logistics, and establish a full process cold chain distribution system.

The Implementation Opinions on Accelerating the High-quality Development of Cold Chain logistics Transportation propose to improve the network of production and sales cold chain transportation facilities. Support county-level logistics centers and township transportation service stations with conditions to expand their cold chain logistics service functions, provide operational sites for facilities and equipment such as pre-cooling, refrigeration and preservation, mobile warehousing, and low-temperature sorting in agricultural product production areas, and improve the conditions for cold chain logistics facilities in the “first kilometer” of agricultural products production areas.

The Opinions on Accelerating the Development of New Consumption through New Business Forms and Models accelerates the promotion of new service models for agricultural products such as “fresh e-commerce+cold chain home delivery” and “central kitchen+cold chain delivery of ingredients”. Fill in the gaps in cold chain logistics facilities for agricultural products, accelerate the construction of equipment for distribution, packaging, and pre-cooling of agricultural products, as well as storage facilities such as distribution warehouses and pre-warehouses.

The Notice on Further Strengthening the Construction of Cold Chain Facilities for Agricultural Product Storage and Preservation further promotes the construction of cold chain facilities for agricultural product storage and preservation, standardizes process management, increases policy support, emphasizes supervision and management, optimizes guidance services, and maximizes policy benefits.

(2) Talent advantages

Siping has gathered various talents in scientific research, engineering technology, survey and design, business management, consulting services, etc. Jilin University, Changchun University of Science and Technology, Changchun University of Technology, Northeast Normal University, Jilin Normal University, Jilin Academy of Agricultural Sciences, Jilin Academy of Agricultural Engineering, and Siping Science and Technology Research Institute have provided talent support for Siping’s development, forming a complete talent training and growth system. Siping has obvious advantages in terms of labor resources, with a high proportion of skilled workers in the urban agglomeration of Northeast China. The labor force is in a dividend period, and labor costs are relatively low. There is a large number of high-quality industrial workers who can meet the needs of various enterprises.

(3) Location advantages

Tiexi District, Siping City, Jilin Province, is located in the central area of Northeast Asia, on the Harbin-Dalian first-level development axis for revitalizing Northeast China. It is the bridgehead for the southern opening of the Harbin-Changchun Urban Cluster and the main pivot city of the central innovation and transformation core area of Jilin Province. Beijing-Harbin and Harbin-Dalian railways pass through the territory. Beijng-Harbin and Ji’an-Shuangliao expressways, as well as No. 102 and No. 303 national highways, traverse the entire region, providing convenient transportation in all directions.

1.2 Contents and scale of project construction

1.2.1 Production scale and product scheme of the project

After the completion of the project, the cold storage capacity will be 200000 tons, including a freezing capacity of 149500 tons and a refrigeration capacity of 40500 tons.

1.2.2 Construction contents of the project

The overall project plan covers an area of 110000 square meters, with a total construction area of 106740 square meters for new buildings, including one new cold storage building with a construction area of 100500 square meters; build 1 new comprehensive office building with a construction area of 6090 square meters; construct a new security guard room with a building area of 150 square meters. Purchase 69 sets of cold storage equipment, 24 sets of information technology equipment, 89 sets of inspection equipment, and 50 transportation vehicles.

1.3 Total investment of the project and capital raising

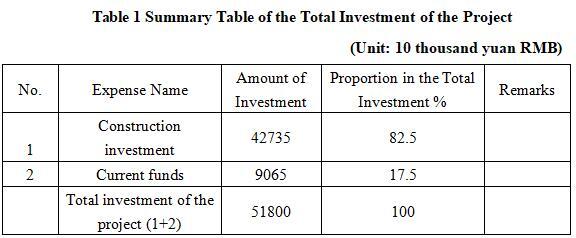

The total investment of the project is 518 million yuan, including the construction investment of 427.35 million yuan.

1.4 Financial analysis and social evaluation

1.4.1 Main financial indexes

After the project reaches the production capacity, its annual sales revenue will be 301.865 million yuan, its profit will be 99.615 million yuan, its investment payback period will be 7.2 years (after the tax, including the construction period of 2 years) and its return on investment will be 19.2%.

Note: “10 thousand yuan” in the table is in RMB.

1.4.2 Social evaluation

The development space of the national frozen conditioning market is huge, but some enterprises can only rent factory buildings for production due to the lack of their own production workshops. Due to remote production locations, inconvenient logistics, incomplete infrastructure such as water and electricity, they cannot meet normal production needs, and limited production space, it is difficult to achieve large-scale production. Therefore, it seriously restricts the further development of enterprises. Therefore, the construction of this project will be an excellent opportunity for settled enterprises to achieve leapfrog development, and it is of great significance to ensure the food safety of frozen food in Siping City. Simultaneously, it addresses the issue of idle labor and resources in the region, and helps the local people to lift themselves out of poverty and become prosperous.

1.5 Cooperative way

Sole proprietorship, joint venture or cooperation

1.6 What to be invested by the foreign party

Funds, and other methods can be discussed face-to-face.

1.7 Construction site of the project

Tiexi District, Siping City

1.8 Progress of the project

The project proposal has been prepared.

2. Introduction to the Partner

2.1 Basic information

Name: Government of Tiexi District, Siping City

Address: 2118 Haifeng Street, Tiexi District, Siping City

2.2 Overview

Tiexi District is located in the central and western part of Jilin Province, west of Siping City. It faces Tiedong District across the Changchun-Dalian Railway to the east, borders Changtu County in Liaoning Province to the southwest, and is adjacent to Lishu County to the northeast. The total area of the district is 176 square kilometers, with one township (20 villages), five street offices (39 communities), and one circular economy demonstration zone under its jurisdiction. The total population is 256000, and the urban infrastructure is complete. The city has a beautiful appearance and is the location of the CPC Siping Municipal Committee and Government, as well as the political, economic, cultural, commercial, technological, and educational center of Siping City. The Harbin-Dalian High-speed Railway Passenger Dedicated Line, Beijing-Harbin, Siping-Qiqihar, Siping-Meihekou and other major railway trunk lines intersect in the urban area. No. 303 National Highway, No. 102 National Highway, Changchun-Siping, and Siping-Shenyang Expressway run through the north and south, making it an important transportation hub in Northeast China.

2.3 Contact method

2.3.1 Contact method of the partner

Contact unit: Bureau of Commerce of Tiexi District

Contact person: Yuan Bosi

Tel: +86-13304345300

E-mail: sptxzsb@126.com

2.3.2 Contact method of the city (prefecture) where the project is located

Contact unit: Siping Bureau of Economic Cooperation

Contact person: Wen Dacheng

Tel: +86-434-3260536

E-mail: spjhjjhk@163.com